- Features

- Net WorthUse several data connectors to track your net worth

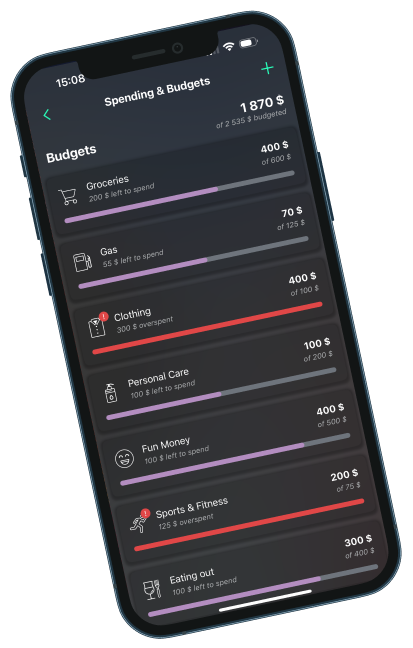

- BudgetingFlexible budgeting tools, custom categories and rollovers to stay on track

- RecurringManage all your paychecks, bills and subscriptions in one place

- Debt Payoff PlanYour personal payoff schedule based on the strategy and budget

- Spending InsightsAnalyze your tracked spending data to better adjust your budget

- PFM CourseLearn more about personal finance, from budgeting mistakes to debt management

- Financial GoalsSet a goal to make sure it is achievable and fits your budget using SMART

- TransactionsSee all transactions from all of your financial institutions in one list

- LeftoverAlways know how much spending money you have after budgeting for necessities

- Lower Your BillsNegotiate better rates for your cell phone or cable bills with Billshark

- Cancel SubscriptionsFind unwanted subscriptions you would like to cancel and save your money

- Cash FlowTrack your profit or deficit by analyzing your recurring and variable expenses

- Resources

- Get Started RightSet up your account by following simple steps and recommendations

- Budget CalculatorPlay around with your budget numbers to understand where your money is going

- SecurityLearn more about security measures and your data protection

- Debt Payoff CalculatorEnter your debt details to calculate an optimal payoff plan tailored to your needs

- NotificationsGet weekly reports and alerts for fees, upcoming bills, and budget progress

- Solutions

- PocketGuard APIIntegrate PocketGuard to enhance user retention and engagement

- White LabelGet your budgeting app powered by PocketGuard to improve your business

- Affiliate ProgramBecome our partner and earn more money by acquire more people to PocketGuard

- Company

- What’s NewCheck back here for the latest updates to PocketGuard

- BlogRead articles on personal finance, savings tips, and more

- AboutLearn more about who we are, our mission, and what we value

- Help CenterFind out more info about how to use PocketGuard and how it works

- Pricing