The majority of young adults often leaves college under a mountain of debt in the form of student loans, credit card debts, and other obligations. This debt can weigh you down and prevent you from investing, buying a home, and growing your finances in the next few years of your life. So, the key is to pay off become debt-free as quickly as possible.

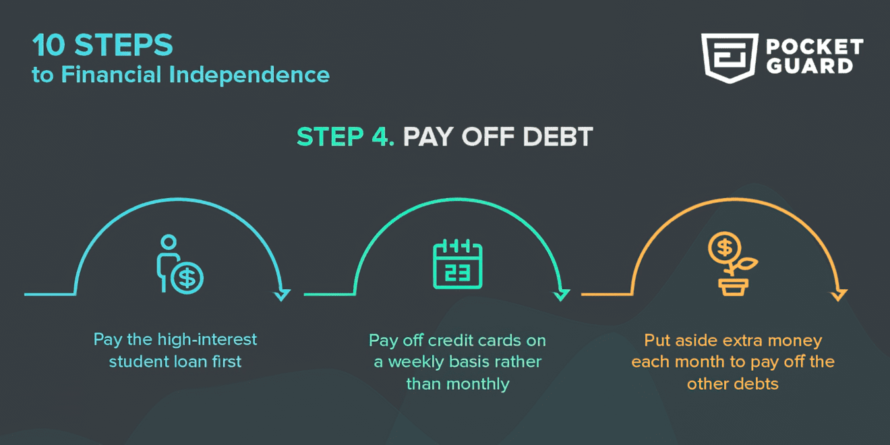

STEP 4: PAY OFF DEBT

Pay off student loans

Student loans are millennials’ principal debt. Most grads will have multiple loans, with different interest rates and repayment schedules. Here is what you can do to pay off student loans.

- Find out forgiveness options. For this, ask your lender or check for details online.

- Determine the grace period you have for each student loan. It is usually 6 months for Stafford loans and 9 months for Perkins loans. Grace periods for private loans will vary.

- Connect with the lender and figure out which is the best repayment option for you.

- Start making payments on your student loans as quickly as possible. Also, if you can pay more than the required monthly payment, do it. This will lower the overall interest on the loan.

- Pay the high-interest student loan first.

- If possible, look at debt consolidation. Speak to different lenders, if you can consolidate your student loans into one and enjoy a lower interest rate on it.

Pay off credit cards

You may have used your credit cards quite a bit as a student, but now as a college graduate, credit card debts will return to haunt you. They will have an adverse effect on your credit score and if you default, it could make it impossible to rent a home or even get a job. So, look to pay credit card debt as quickly as possible since the interest rate is high on this sort of debt.

- Pay more than the minimum required amount. It may not pay off the debt, but will help to extend it without affecting your creditworthiness.

- Learn to pay off credit cards on a weekly basis rather than monthly.

- Pay regularly to reduce your credit card debt over a period of time

- Learn to start using cash for buying things instead of your credit cards. This will ensure you just purchase things you need and avoid impulsive shopping.

Pay off other debt

You may have racked up other debt, such as auto loan, and that will eat into your finances. So, it is time to become a responsible adult by paying off this debt. Here is how you can do it.

- Determine what you spend your money on each month. See if you can cut down on unwanted small things.

- Put aside extra money each month to pay off the other debts.

- Extra money can be saved by avoiding eating out or shopping less.

- Sell unwanted things online, on sites like eBay and Craigslist. Use the money to pay off debt.

- Get a second job to help you earn more. Use this money to clear other debts as well as credit card debt.

- If you have a car, use it until it is debt-free and then sell it. Use the money to clear your debts and then use public transportation to move around if available. Or ride a bike!

These are way millennials can pay off debt with the PocketGuard app and become financially independent. It may be a tedious process to begin with, but once you start doing it and you see how your debt is reduced, you will be motivated to continue until you are truly debt-free. Seek professional help if you can’t do it on your own. There are financial counselors and loan consolidation companies that can come to your rescue. But do your due diligence before authorizing such a service! Good luck!

Aug 03, 2017

Aug 03, 2017